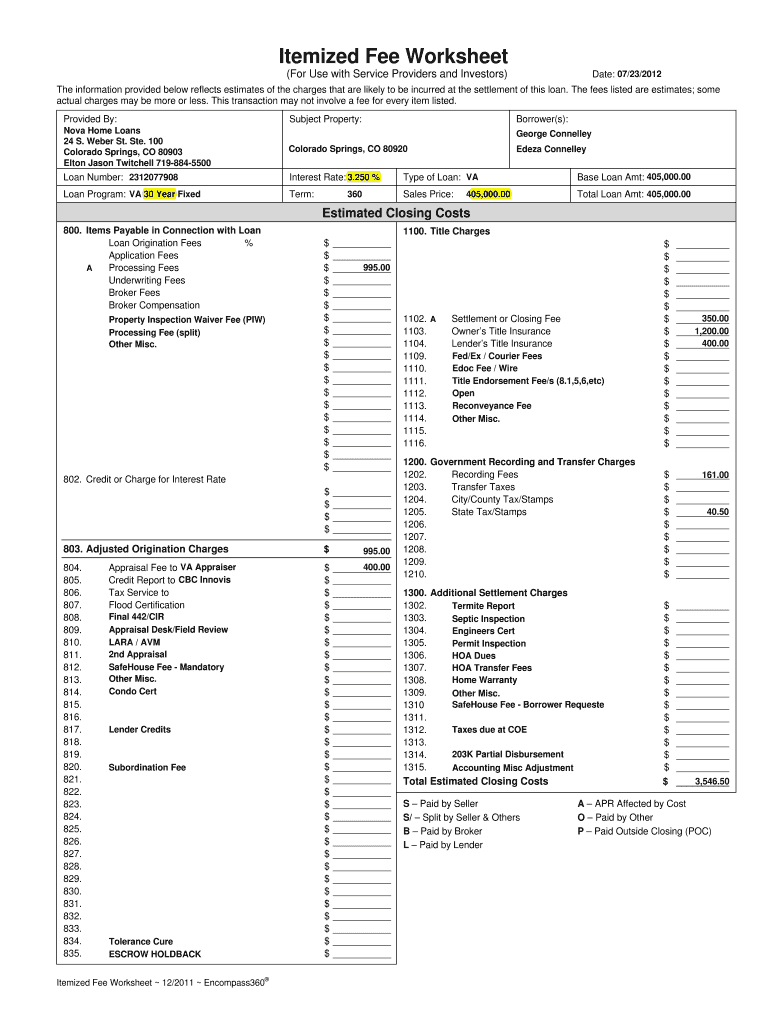

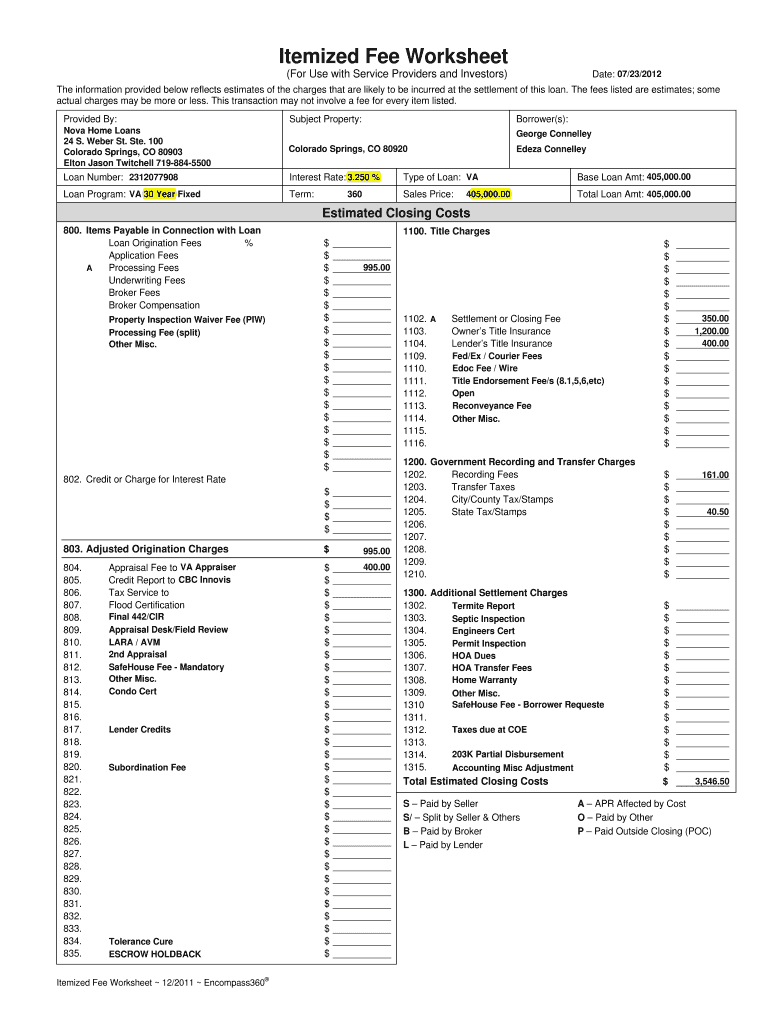

Encompass360 Itemized Fee Worksheet 2011-2024 free printable template

Get, Create, Make and Sign

Editing mortgage itemized fee worksheet excel online

Encompass360 Itemized Fee Worksheet Form Versions

How to fill out mortgage itemized fee worksheet

How to fill out closing cost excel spreadsheet:

Who needs closing cost excel spreadsheet:

Video instructions and help with filling out and completing mortgage itemized fee worksheet excel

Instructions and Help about closing cost worksheet pdf form

Hi guys this is Sue Ellen and Abby home loans how are you thanking for coming back to go over this detailed closing cost worksheet now the reason I decided to do this video was one of my borrowers called me not long ago, and we were in a45-day escrow we were like five days out ready to close, and she called, and she said you know Sue Ellen I'm done×39’t remember what you told us about how our loan amount got to be this dollar amount and then there was another fee she had these worksheets, but there was another fee that she was asking me about, and I felt bad she was I've been going to ask you, but I just didn't×39’t want to have to ask again because I know you explained it thus before, and I thought how sad I don'twant someone to have too self-conscious to ask questions, and you have to understand typically a homeowner only buys one or two homes, and they are only going through the loan process handful of times in their lifetime so remembering all this stuff is not something they really need to do, but they do need to understand it to close okay, so I decided to do this video so that I can give to my borrowers and that way if they want to go back two or three times and go over it is will help them to understand what that×39’re paying for and how much money they're bringing into close so with that let×39’s go this lists I'm going to go over it slowly and do it in detail, so you understand it Know it×39’s going to take a few minutes but if you can bear with us, we×39’ll get through it and I think you'll you×39’get Somme good information at the end okay, so this is an FHA purchase for $400,000these are my borrowers Mickey and MinnieMouse night couple just by the way anyway our estimated closed date was July 16th Andre took the application on June the second, so we were in a 45-day escrowokaythe loan amount is three hundred and ninety-two thousand seven fifty-five that was the question that my borrower called me about okay the purchase price of four hundred thousand dollars less than three and half percent down that FHA requires fourteen thousand dollars down plus the upfront mortgage insurance premium Wichita×39’s added to the amount okay their×39’s both an upfronmortgage insurance and a monthly print and monthly premium that you pay on FHAloansso this 67-55 that got added to the loan amount was what was your know making it what she didn't×39’t understand because it's listed here in this list of fees, but you're not it's not coming out of pocket it's getting added to the loan amount excuse me okay, so we have origination fees there'SA processing and an underwriting Geetha×39’s going to the lender then appraisal fee of four hundred and fifty dollars now I'm on the Central Coast of California and that's a standard fee for a single-family residence in my area appraisal fees can be a little higher little lower depending on where you know where you×39’re at then the credit report fee remember we pull credit whence first started the loan, so I...

Fill itemized fee worksheet explained : Try Risk Free

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your mortgage itemized fee worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.